us japan tax treaty article 17

Article 24 of the USUK. Taxpayer in the United States under the Business Profits article of the treaty.

Article 17-----Independent Personal Services Article 18-----Dependent Personal Services.

. Article 28 also provides for. The Saving Clause-----Paragraph 3 of Article 4 TAX CONVENTION WITH JAPAN. By providing credit to the extent of tax already paid in the US The tax paid by Mr X in the US will be eligible for deduction in India.

Recent treaties of certain countries have contained an article intended to prevent treaty shopping which is the inappropriate use of tax treaties by residents of third states. The Kyoto Protocol was an international treaty which extended the 1992 United Nations Framework Convention on Climate Change UNFCCC that commits state parties to reduce greenhouse gas emissions based on the scientific consensus that part one global warming is occurring and part two that human-made CO 2 emissions are driving it. The DTAA applies to the residents of the contracting states ie.

If the Treaty Article Citation includes a P that refers to a protocol that amends the treaty article. MESSAGE FROM THE PRESIDENT OF THE UNITED STATES. Article 2326 Income Tax PPh 2326 Domestic Article 23 WHT is payable at the rate of 2 for most types of services where the recipient of the payment is an Indonesian resident and 15 for a variety of payments to resident corporations and individuals.

Form 17 - US PDF381KB Form 17 - UK applicable to payments made before December 31 2014 PDF399KB Form 17 - UK applicable to payments made on and after January 1 2015 PDF428KB Form 17 - France PDF421KB Form 17 - Australia PDF395KB Form 17 - Kingdom of the Netherlands PDF521KB. News on Japan Business News Opinion Sports Entertainment and More. 26 WHT of 20 is applicable.

Applicability of the agreement. Tax treaty for example would help alleviate this particular situation. A reference to 2P or 5P would be.

In addition a foreign corporation is subject to a 30 tax on the gross amount of certain US-source income not effectively connected with that business see section IIP1 below with respect to withholding on certain payments to non-US persons. Such 30 tax potentially may be reduced or eliminated under an applicable US tax treaty. Before you run out and file this form talk to a Tax Advisor.

THE MULTILATERAL CONVENTION TO IMPLEMENT TAX TREATY RELATED MEASURES TO PREVENT BASE EROSION AND PROFIT SHIFTING. These limitation on benefits articles deny the benefits of the tax treaty to residents that do not meet additional tests. Attachment for Limitation on Benefits Article.

On or after January 1 of the year following the year in which the treaty enters into force. India and USA subject to certain exceptions. Tax benefits you get from treaties dont have to be claimed with Form 8833.

The majority of USUK. The DTAA applies to the following taxes. See also Table 3 List of Tax Treaties.

The Income Tax Department NEVER asks for your PIN numbers. To claim it youd file Form 8833 and include your situation in the summary. 166 Records Page 1 of 17 ADEN Rules 1953.

The 25 Moments From American History That Matter Right Now Time

Explainer Details On Car Tariffs Fuzzy As U S Japan Head For Trade Deal Reuters

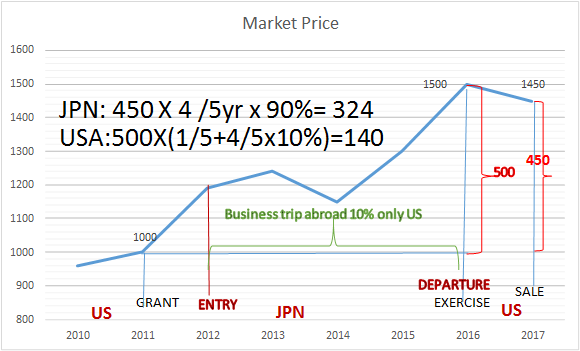

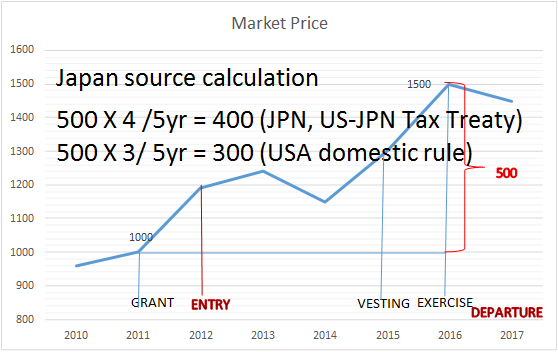

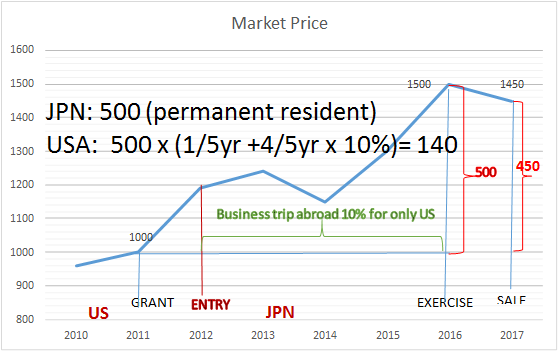

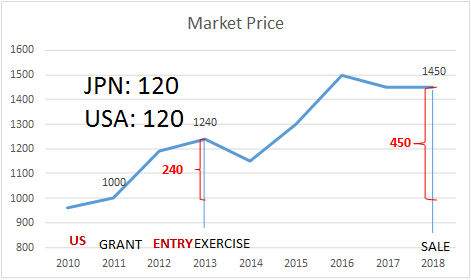

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Gms Flash Alert Covid 19 Kpmg Global

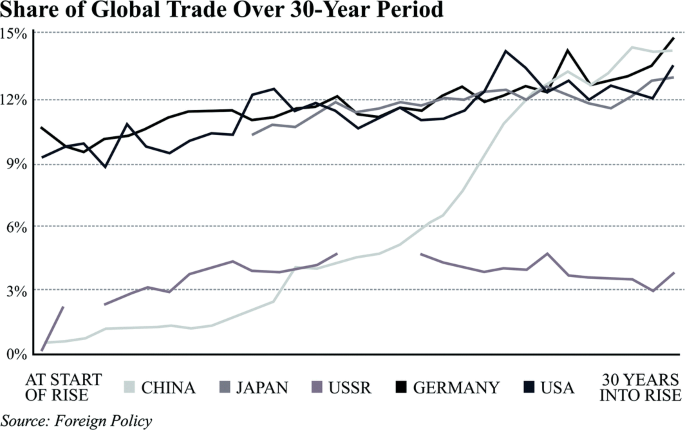

The Post American World Middle Powers And The Coalition Of Deterrence Springerlink

Why Didn T The U S Annex Japan After Ww2 Quora

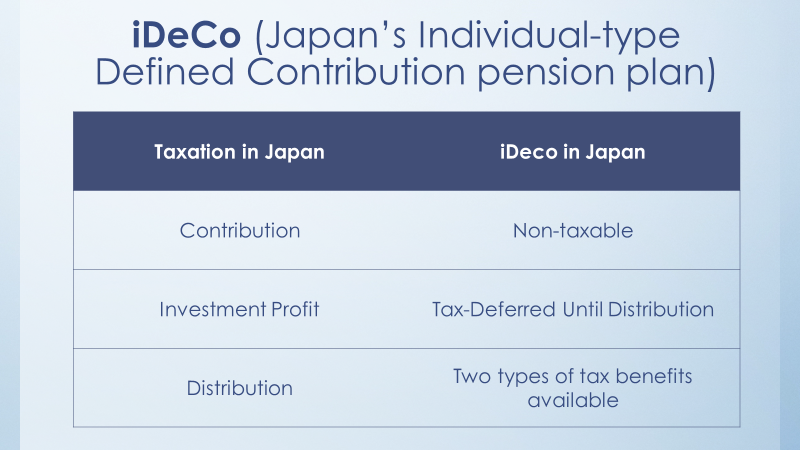

Help Your Japanese Spouse Retire In Japan By Using Ideco Cdh

Mexico Tax Rates Taxes In Mexico Tax Foundation

What Countries Have Won Nobel Prize In Chemistry Answers Nobel Prize In Chemistry Nobel Prize Nobel Prize In Physics

The Kuril Islands Are A Chain Of Islands In The Northwestern Pacific Disputed By Russia And Japan R Mapporn

The World Says Yes To A Cradle To Grave Plastics Treaty Now The Work Begins

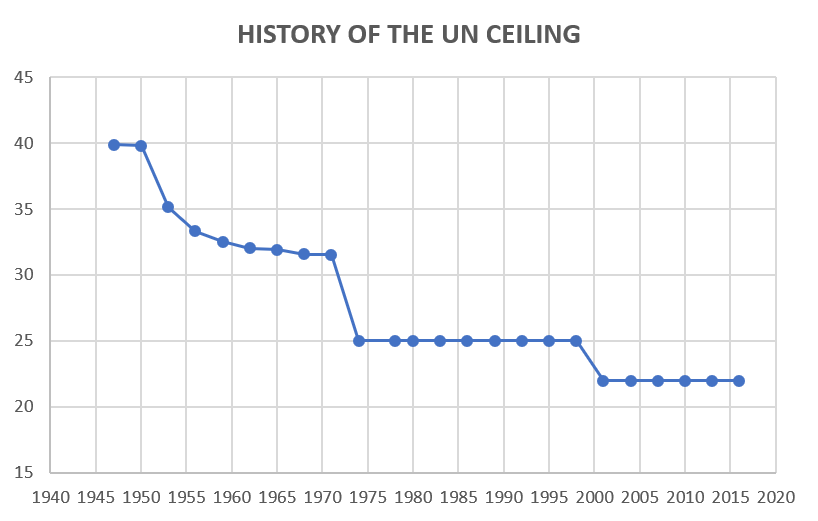

Un Scales Of Assessment Explaining The Un Budget Formula In 9 Questions Better World Campaign

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Why Didn T The U S Annex Japan After Ww2 Quora

Japan Set To Reap Benefits Of Tax Windfall International Tax Review